A bank is a financial institution that provides financial services to people. They are licensed to receive all the deposits and provide loans.

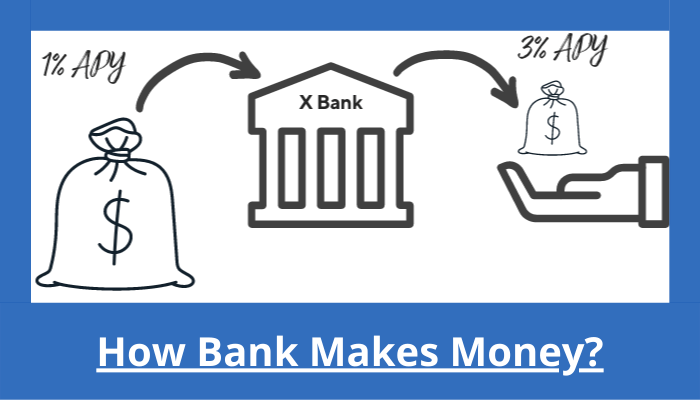

Banks make money by borrowing it from depositors and compensating that borrowed amount with a certain interest rate. Banks sell their money in the form of loans that they provide to common people.

The interest rate which they charge on individuals while taking a loan is very much higher than the interest which they have to give in the depositor's account.

Banks also charge money for the services which they provide.

The money generating process of banks is divided into three main processes:-

- Interest Income – Interest Income is the first important thing in the money generating process. It is the primary way through which most commercial banks make money. Interest Incomes are the revenue which is earned by banks which they charge for the use of their funds.

- Capital Market-related Income – The capital market refers to the place where buyers and sellers are indulged in trading. It is a type of financial market in which long terms debts are bought and sold. Big financial regulators such as SEBI ( Security Exchange Board of India), Bank of England ( BOE), and U. S securities and exchange Commission overseas capital markets protect all the investors from different types of fraud and other duties.

- Fee-based Income – A fee income presents the income earned by all banks for providing services. Its services include Demand drafts, Telegraphic transfers, brokerage and income earned on forex transactions, and distribution of third-party products.

How do Banks Earn Profits?

Banks earn profits in various ways.

- Net Interest Margin – Net Interest Margin ( NIM) generally means the amount of money that any bank is earning as Interest on the loan which they are providing as compared to the amount of interest the bank is paying as interest on deposits. It is the industry-specific probability ratio for all banks and other financial institutions.

- Interchange fees – Another source of income for banks is the Interchange fees. It is the fee charged by the bank from the merchant who possesses a credit card and the debit card payment.

According to Bloomberg, the merchants pay $100 billion in interchange fees annually.

Some examples are:-

- Credit Card fees

- Checking Accounts

- Savings Accounts

- Mutual fund Revenue

- Investment management fees

- Custodian fees

So by the above-mentioned points, the bank makes money.

-black.png)