Financial literacy is very much important in everyone’s life. Teaching kids about financial literacy is essential for the growth and development of every child.

As Children of today are the youths of tomorrow. If kids will get financial literacy, then they are able to make the appropriate use of their money.

It will also help them to become successful in their life. Financial literacy is as important as getting an Education about other things. It is an effective component for the holistic development of a child.

Teaching children how to spend and save money in an effective way, is very much important for children. It means teaching children about money management.

What is Financial literacy?

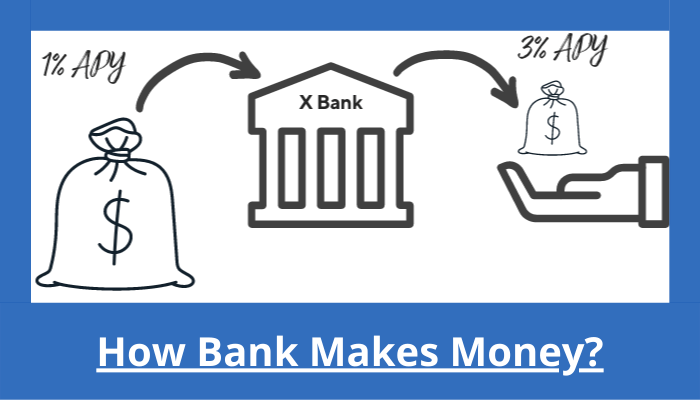

• Financial literacy is the capacity and ability to understand the effective use of money and financial resources. It helps in gaining insights into how to utilize money and learning about the importance to save money.

It is a kind of knowledge for managing financial resources properly and learning about their utilization.

• Financial literacy helps in making appropriate financial choices in life. Gaining knowledge about it will not only enhance a person well being but also open doors for success, prosperity, and economic stability.

Why financial literacy is important?

Financial literacy is the key to the holistic growth and development of a child. Teaching financial literacy helps in learning about the importance and need for money.

It helps in developing intellectual understanding. If a child can learn how to save money and use it in an effective way, then it helps them in becoming successful in their life.

Teaching financial literacy in schools and colleges can make a big difference. It will help youths to gain knowledge and insight about the proper utilization of financial resources.

It is very important in empowering young minds. Being financially literate individuals are able to take a charge of their lives. It also helps in boosting their confidence.

A person who has to learn about financial literacy is able to make a positive impact on society and can empower many other people also.

If a child learns financial literacy at a very early age, then he is able to save money. We give pocket money to our children. When they are learning how to make effective use of money

Financial literate individuals are able to handle their finances more effectively and confidently. They are able to take an effective decision at difficult times in their life.

They are able to manage issues that are related to finance.

There are six main components of financial literacy

- Earn

- Spend

- Save

- Invest

- Borrow

- Protect

Raising children well is an important and challenging process. In today's modern, it is very much important to give every child knowledge about all things.

And teaching them financial literacy is significant for their future. According to studies, At the age of seven, a child can learn about financial literacy.

It is important for every parent to nurture their child in a way, which can make a positive impact on our society. It can help them in securing their future and families.

Research shows that children who learn financial literacy are able to invest and save money in an effective way. They are more successful in their lives also.

So, Financial literacy is important for raising kids in a better and more impactful way so that they can become useful assets for the society.

-black.png)